How did a meal in Glasgow lead to the UK’s first green debit card made from recycled ocean plastic?

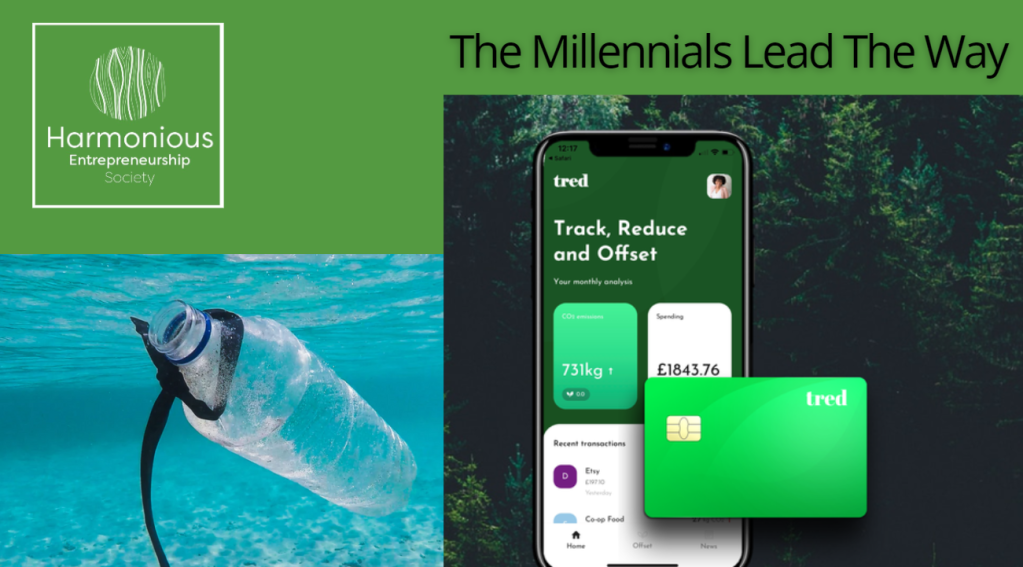

Well, it is quite simple, over a meal with a friend, one of the co-founders of the Tred card, 27-year-old Will Smith, was engaged in a discussion over which killed more turtles, the plastic straw, or a flight from London to Scotland. Smith and his friend soon realised that it is unclear and nobody really has any idea what impact they are having on the planet. So out of this discussion, Smith and his fellow Durham University Engineering alumnus, 28-year-old Peter Kirby, came up with the idea for a debit card and app that will track, reduce and offset the owner’s carbon footprint – a card that will not just enable the owner to buy things but to fight climate change.

In the UK there are 90 million debit cards and 50 million transactions a day, averaging £36 per transaction and generating 8.64kg of CO2 per transaction. However, according to the market research, Smith and Kirby undertook before launching their project, some 90 percent of those surveyed did not know what their carbon footprint was, though most wanted to know and, importantly, wanted to reduce it. So, they set about not only developing the concept but the algorithm that converts the amount and type of spend into kilograms of carbon emitted. Each month, not only does the card tell users where and how their impact is greatest, but it helps them to reduce it and offset the impact. This is achieved by Tred planting trees to capture the CO2 in proportion to the spend and as a percentage of the profits.

Essentially Tred is what is known as a “challenger” bank, a new online form of banking that is challenging the more traditional, long-established “legacy” banks by using the new financial technology (Fintech) to avoid expensive overheads, such as buildings. Such banks, which have developed in the UK as a result of the 2008 financial crisis and the subsequent Financial Services Act of 2012, target the millennials or Prensky’s (2001)“Digital Natives” – young adults who are comfortable using the Internet, mobile devices and social media. However, Tred is also targeting the eco-conscious parents of the millennials who are loyal to their legacy bank but wish to know more about their carbon footprint and reduce it if possible. Hence it has developed a system that permits them to use their existing plastic cards to retrieve all of the information that a Tred card-holder would receive.

While the UK’s 40+ challenger banks are growing rapidly and creating problems for the more traditional legacy banks, which have seen their market share drop from 92%+ to around 70%, Tred’s focus on sustainability gives it a competitive advantage. As 82% of people in the UK want to lead more sustainable lives but do not know how to, the aim of Tred is “to help everyone to lead a greener life” says Will Smith. Indeed, according to his co-founder, Peter Kirby,” Tred’s mission is to become THE green Fintech, providing a platform that lets people effortlessly manage their money, and its impact, all in one place”. While both Smith and Kirby believe that “small steps lead to big changes” (Andrews, 2021) in April 2021 Tred raised its £400,000 crowdfunding target on Crowdcube in just 2 hours and closed its funding campaign with £1million and 1000 investors. Apart from demonstrating the support for their project, such funding will help enable the founders to fulfill their plans, which include coaching members in how to become more eco-friendly, offering a wider range of carbon offsetting schemes for users to choose from, and investment opportunities in green technology firms.

Through its green debit card and app, Tred and its partners (Forest Carbon, Stripe, Woodland Carbon CO2de) are well on the way to delivering a green money solution to the sustainability grand challenge. While it is a commercial profit-making enterprise the founders are determined to fight climate change, so it is addressing not just SDG 8 (Decent work and economic growth), but SDG 13 (Climate Action) as well SDG 9 (Industry, Innovation, and Infrastructure), SDG 11 (Sustainable Cities and Communities), SDG 12 (Responsible Consumption and Production), SDG 16 (Peace and Justice Strong Institutions) and SDG 17 (Partnerships to achieve the Goal).

As with many graduate start-ups, the founders used the University’s Business School in their early days to help “bring their idea to life” and worked with the University’s Enterprise Manager, Tarek Tokarski, and his team in Careers and Enterprise, to access grants and coaching/mentoring.

As the late Nelson Mandela recognised “Education is the most powerful weapon which you can use to change the world”.

References

Andrews, B (2021), Could this Green Debit Card Help You live your life more Sustainably? The Forward Lab. 14th January.

Bignell, F (2021), New Carbon Tracking Debit Card, Tred, incentivized by Inevitable Green Revolution. The Fintech Times.com April 7.

Prensky, M., (2001), Digital Natives, Digital Immigrants. On the Horizon. 9(5), 1-6.

Strick, K., (2020), Tred: like a sustainable Monzo that tracks your carbon footprint as you spend Evening Standard, 16th December.

© Professor David A. Kirby and Harmonious-Entrepreneurship.org (2021). Unauthorized use and/or duplication of this material without express and written permission from the author is strictly prohibited. Excerpts and links may be used, provided that full and clear credit is given to Professor David A. Kirby and Harmonious-Entrepreneurship.org with appropriate and specific direction to the original content.

Great new business and right on-trend raising so much capital through Crowd-funding – people are ready for something new and ethically responsible.

LikeLike

Thank you for your contribution Bev, always lovely to hear your voice

LikeLike